Considerations To Know About Fredericksburg bankruptcy attorney

Mr. Bolger was quite affected person and comprehension of our predicament. He took the time to hear and assuaged any fears we had. Yaphet K. Check out full assessment listed here

Determined by your jurisdiction, the trustee will mail you periodic statements demonstrating creditor payments. You will be in the position to entry the knowledge within the trustee's Web page. Get hold of the trustee for Guidelines.

Homeowners that are acquiring issues creating property finance loan payments and/or have fallen at the rear of on their payments might have selections that will let them to prevent foreclosure and bankruptcy.

Credit Counseling – Nonprofit credit rating counseling companies provide cost-free budgeting advice and suggestions for other credit card debt-aid alternatives.

Filing bankruptcy will influence your credit history score for so long as it seems on the credit rating report, even though the negative influence does diminish eventually.

Photoroyalty/Shutterstock Bankrate is always editorially independent. While we adhere to strict editorial integrity , this put up may perhaps include references to goods from our associates.

Fulfill your court docket-appointed trustee who will overview your circumstance and Arrange your creditor Assembly. On the Assembly, you will response questions about your financial debt as well as proposed plan.

The complex storage or access is necessary for the respectable websites objective of storing Choices that aren't requested because of the subscriber or consumer.

At Fisher-Sandler we delight ourselves in aiding Each and every and each customer. No matter whether which is with the filing of chapter seven, chapter thirteen or chapter 11 bankruptcy or following undergoing your monetary scenario we the two come to the conclusion that bankruptcy may not be your best choice.

Not all companies qualify for our try this website system, but we hope we may help yours. If your organization does qualify, we will indicator you up within the spot and get you quick-tracked over the highway to economical liberty.

Chapter thirteen bankruptcy presents debtors with their backs versus the wall some breathing space. It go to these guys stops collections, which includes foreclosures and repossessions. It will have to have you to repay some debts, typically more than 3 to 5 years.

S. Trustee Method-authorised company. This study course assists assess regardless of whether you make more than enough income to pay for back those you owe. The course has to be taken inside of one hundred eighty days just before filing for bankruptcy. The counseling cost is this website about $50.

Once you (or your law firm) file your paperwork, you’ll then have a letter in the courtroom clerk notifying you, your creditors, along with your court-appointed trustee that collection actions on your own accounts are already suspended. Which means creditors have to prevent hounding you for payments.

Follow the repayment plan about three to 5 years. Your trustee will obtain and click to read more distribute payments throughout this time. When you’re performed with repayment, the bankruptcy case will be discharged.

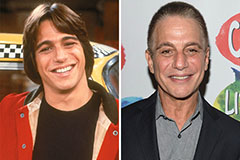

Tony Danza Then & Now!

Tony Danza Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!